US West Coast Ports Experience Significant Import Volumes Amid Fears of January ILA Strike

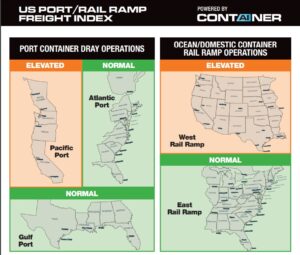

The December ITS Logistics US Port/Rail Ramp Freight Index reveals that East and Gulf ports are seeing the normal December calm post-retail peak and prior to the Lunar New Year. Surprisingly, the US West Coast ports are still experiencing significant import volumes, which may result from some inventory being pulled forward to avoid possible tariffs and the expected International Longshoremen’s Association (ILA) strike activity in January. The potential strike activity that could take place in combination with a Lunar New Year volume spike is something ITS is keeping a close eye on, as both are set to occur fairly close together on the calendar.

“The volumes coming from Asia on the trans-Pacific trade routes are not overwhelming the supply of capacity as spot rates at origin are not being pushed higher,” said Paul Brashier, Vice President of Global Supply Chain for ITS Logistics. “For the time being, everything seems balanced. That said, if the US West Coast continues to be a release valve for a potential ILA strike supply chain disruption, there is a high risk that both West Coast Port and Rail operations could become overwhelmed.”

According to Drewry’s World Container Index (WCI), spot rates on the Shanghai-New York leg were down 3% week over week, to $5,761 per 40ft, but Shanghai-Los Angeles was down 5% week over week to $5,071 per 40ft. The Xeneta XSI transpacific route also declined 2.5% to $5,489 per 40ft. Overall, the total October containerized import volume across US ports amounted to 2.25 million twenty-foot equivalent units through ports covered by the Global Port Tracker, which was off by 1.2% from September but ahead 9.3% from October of last year. Ports have not yet reported November’s numbers, but Global Port Tracker projected the month at 2.17 million TEU, up 14.4% year over year.

Earlier this month, the ILA warned that another coastwide strike could occur when management from the United States Maritime Alliance (USMX) confirmed their intent to implement semi-automation. This directly contradicted the USMX opening statement, assuring the ILA that neither full nor semi-automation would be an option moving forward. Although both sides agreed to extend the current contract until January 15, 2025, as of last week, neither party has chosen to pursue a new stance on implementing semi-automated rail-mounted gantry cranes (RMGs).

“While the industry awaits the latest update pertaining to the strike, professionals must also be aware that rail operations in Seattle and Los Angeles are continuing to struggle with interior point intermodal (IPI) freight and higher volumes of domestic peak retail freight,” continued Brashier. “Due to many shippers avoiding IPI legs and rail service for domestic goods, we are starting to see considerable capacity strain and upward rate pressure for lanes moving West-East on over the road capacity.”

Just last month, it was reported that rail dwell times at the Port of Long Beach were at about four days as of Nov. 12, according to the port’s operations dashboard. The Port of Los Angeles’ on-dock average rail dwell times were close to eight days as of Nov. 13, as noted in the port’s operations report.

ITS Logistics offers a full suite of network transportation solutions across North America and distribution and fulfillment services to 95% of the US population within two days. These services include drayage and intermodal in 22 coastal ports and 30 rail ramps, a full suite of asset and asset-lite transportation solutions, omnichannel distribution and fulfillment, LTL, and outbound small parcel.

The ITS Logistics US Port/Rail Ramp Freight Index forecasts port container and dray operations for the Pacific, Atlantic, and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions. Visit here for a full comprehensive copy of the index with expected forecasts for the US port and rail ramps.